The United Kingdom’s approach to digital market regulation has undergone a significant transformation in 2025. What began as legislative theory in May 2024 with the Digital Markets, Competition and Consumers Act (DMCCA) receiving Royal Assent has evolved into a sophisticated regulatory framework delivering tangible results. As we reach 20 August 2025, the close of consultation periods for the Competition and Markets Authority’s (CMA) first Strategic Market Status (SMS) designations, it becomes clear that the UK has charted a distinctly different course from the EU’s prescriptive approach. Find out more about the latest updates on the DMA’s UK sister act in our blog below. For in in-depth overview of the DMCCA, click here.

by Anush Ganesh

From Theory to Practice: The DMCCA’s Implementation

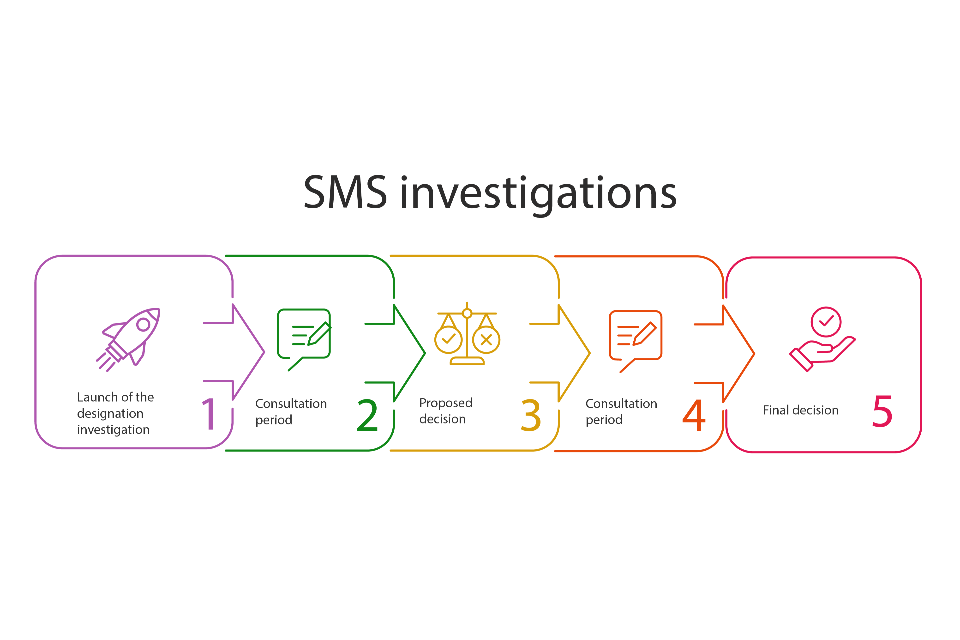

The period from January to August 2025 represented a significant step forward in how the UK approached platform power. The CMA wasted little time in demonstrating the potency of its new SMS designation powers. On 23 January 2025, the CMA launched what would prove to be landmark investigations into both Apple’s mobile platform and Google’s search services. These represented the first serious challenge to the fundamental business models of two of the world’s most powerful technology companies operating in UK markets.

The Apple investigation targeted a platform commanding 50-60% of UK mobile devices, serving almost all UK adults, and underpinning an app economy that generates 1.5% of UK GDP while supporting approximately 400,000 jobs (Para 1.9 of Apple’s Proposed Decision (henceforth APD)). The scope determined was comprehensive yet precise, examining Apple’s mobile operating systems (Para 1.11 of APD), native app distribution (Para. 4.9 of APD), and mobile browser and browser engine activities as an integrated platform (para 1.17 of APD) rather than separate services (Para 4.78 of APD).

Simultaneously, the CMA’s investigation into Google revealed similarly concerning market dynamics. Google’s Mobile Platform commands 40-50% share of UK mobile devices (Para 1.7 of Google’s Proposed Decision (henceforth GPD)), operating within a stable duopoly structure that has remained remarkably consistent over an eight-year period (Para 6.19 of GPD).

Strategic Market Status: Provisional Designations Announced

For Apple, the evidence spans market structure, competitive dynamics, consumer behaviour, financial performance, and technological trends through the study of Apple’s internal documents (Paras 5.15-5.20 of APD).

For Google, the investigation demonstrated how a technology company can maintain market dominance through an integrated ecosystem approach, combining multiple services and leveraging agreements with partners to create substantial barriers to competition that persist even in the face of technological change (Paras 1.11-1.12 of GPD).

What distinguishes the UK’s approach is its activity-specific focus rather than the EU’s broader gatekeeper model (see our SCiDA working paper for a comparative). The CMA’s surgical precision became evident in how it carved up Apple’s ecosystem into four distinct but interconnected activities: smartphone operating system (iOS), tablet operating system (iPadOS), native app distribution (App Store), and mobile browser and browser engine (Safari/WebKit) (Paras 1.14-1.17 of APD).

This granular approach reflects a sophisticated understanding of how platform power operates across multiple layers of the technology stack. Rather than applying standardized obligations across platforms, the DMCCA enables bespoke interventions tailored to specific market failures.

The evidence supporting Apple’s designation proved overwhelming. The CMA’s analysis revealed market characteristics of remarkable stability and concentration, with Apple holding 50-60% of smartphones and 50-60% of tablets in the UK (Paras 6.13, 6.17 of APD). More significantly, this isn’t traditional head-to-head competition. Apple and Google have carved out distinct market segments, with Apple focusing on premium consumers willing to pay higher prices while Google targets price-sensitive segments (Para 6.21 of APD). This price differentiation actually reduces competitive pressure between the platforms.

Consumer behavior data painted a stark picture of market stickiness or brand loyalty (Para 6.36 of APD; (Para 6.31 of GPD). The CMA found that high switching barriers prevent meaningful consumer mobility between platforms (Para 6.27 of APD), while revenue sharing agreements between Apple and Google further dampen competitive incentives (Paras 6.50-6.57 of APD), creating a system where both platforms benefit from the status quo.

Market Power in Practice

The CMA’s historical analysis reads like a technology industry graveyard, demonstrating the futility of challenging the Apple-Google duopoly despite massive resources and strategic advantages. Microsoft, Samsung, Mozilla, and Amazon all failed to crack the mobile platform dominance, with the CMA identifying significant barriers across multiple levels (Paras 6.109-6.113 of GPD), from indirect network effects to component-specific requirements and ecosystem-level integration challenges.

Perhaps nowhere is Apple’s control more absolute than in browser competition. Safari held 86% share on Apple devices in March 2025 (Para 7.35 of APD), while WebKit has 100% share due to Apple’s restriction on alternative engines (Para 7.43 of APD). Despite 100+ browsers being available, Safari faces limited constraint (Para 7.40 of APD).

The financial evidence provided perhaps the most compelling demonstration of Apple’s market power. Operating profit margins never fell below 24% for at least 10 years (Para 8.19 of APD), with return on capital exceeding 100% compared to an estimated weighted average cost of capital of 10-15% (Para 8.20). In the UK specifically, Apple’s 2024 revenue totalled £10-20 billion, with iPhone sales contributing £5-10 billion and the App Store £0-2 billion (Para 8.37 of APD).

Google’s Parallel Investigation: Search and Mobile Integration

The investigation revealed how price segmentation reduces direct competition, with Google dominating the budget segment at 100% of smartphones under £300 while Apple commands 71% of smartphones over £300 (Para 6.25 of GPD). This segmentation means the platforms face limited direct competitive pressure from each other (para 6.27 of GPD).

Consumer switching data proved equally concerning. Among Android users, 76% didn’t consider switching to iOS, while among iOS users, 85% didn’t consider switching to Android (Para 6.31 of GPD). The primary barrier for Android users was cost, with 51% citing iPhones being “too expensive” (para 6.39 of GPD).

A particularly significant finding concerned the Google-Apple Information Services Agreement, under which Google paid Apple £1-3 billion in the UK in 2024 (para 6.64). This arrangement reduces Google’s incentive to compete aggressively for users, since Google retains search revenue even when users switch to Apple (Para 6.65 of GPD).

The Cloud Services Market Investigation

While the mobile platform investigations captured headlines, the CMA simultaneously addressed another critical area of digital market concentration. On 31 July 2025, the CMA published its final decision on the Cloud Services Market Investigation (henceforth CSMI), finding that competition is not working well in these critical markets.

The cloud services investigation revealed market concentration levels that mirror those found in mobile platforms. The Infrastructure as a Service (IaaS) market is highly concentrated, with Microsoft and Amazon Web Services (AWS) each holding 30-40% market share in 2024. The Platform as a Service (PaaS) market shows similar concentration, with Microsoft holding 20-30% and AWS maintaining 10-20% market share. (Paras 3.182-3.195 of the CSMI)

The investigation identified three key adverse effects on competition that directly parallel the mobile platform findings. Market concentration and barriers to entry have enabled Microsoft and AWS to hold significant unilateral market power and earn returns above their cost of capital over sustained periods (Paras 3.493-3.502 of the CSMI). Technical and commercial barriers lock customers into their initial choice of provider, limiting their ability to exercise choice. Most significantly, Microsoft’s software licensing practices reduce competition by adversely impacting the competitiveness of AWS and Google in cloud services supply. (Paras 7.274-7.276 of the CSMI)

DMCCA as the Preferred Regulatory Tool for Cloud Markets

The CMA’s CSMI concluded that the Digital Markets, Competition and Consumers Act (DMCCA) powers are better suited to addressing competition concerns than traditional market investigation tools. As stated in paragraph 10.19 of the CSMI, the UK government designed the new digital markets regime because “existing market investigation tools are designed for one-off interventions and are not well suited to tackling entrenched market power in digital markets.” The DMCCA enables Strategic Market Status (SMS) designations for firms meeting specific criteria, with strong evidence that both AWS and Microsoft would qualify based on their substantial market power, strategic significance in Critical National Infrastructure, and revenues exceeding £25 billion globally (Paras 10.56-10.57 of the CSMI).

The investigation identified four critical advantages of DMCCA powers over traditional remedies (para 10.36 of the CSMI): wide-ranging intervention powers, flexibility for future variation and iteration, powers to test and trial interventions, and ongoing regulatory oversight. Paragraph 10.41 of the CSMI emphasizes the duty to consider on an ongoing basis whether to impose, vary or revoke conduct requirements, while paragraph 10.45 highlights the ability to test and trial different remedies or remedy design options to gain practical evidence on their effectiveness. This approach is essential given the complexity of cloud markets and interactions with EU Data Act requirements (para 10.43 of the CSMI).

Rather than imposing immediate traditional remedies, the CMA recommended that the CMA Board prioritize SMS investigations for AWS and Microsoft in cloud services. Paragraphs 10.48-10.50 of the CSMI explain that targeting these firms (who collectively hold 60-80% of IaaS and 30-50% of PaaS markets) would create ripple effects throughout the market as competitive pressures spread interventions beyond the targeted large suppliers. The CMA announced it will consider further SMS designations in early 2026 (para 10.57 of the CSMI), with SMS investigations requiring completion within 9 months once launched (para 10.60 of the CSMI).

The cloud investigation’s findings on Microsoft’s licensing practices proved particularly damaging. The CMA found significant differences relating to price and quality when customers use Microsoft software products on Microsoft’s cloud rather than AWS or Google’s platforms (Para 9.64 of the CSMI). The input price paid to Microsoft by AWS and Google for some products can be higher than Microsoft’s customer-facing price for some cloud customers, with AWS and Google passing through at least some of these input costs, making them generally perceived as more expensive than Microsoft.

The SMS Levy Rules

Perhaps the most fascinating development has been the emergence of the Draft SMS Levy Rules consultation, published on 05 June 2025. These rules determine how the SMS regime is funded and how costs are allocated among designated firms.

The SMS Levy Rules propose an elegant solution to funding digital market regulation: the levy will be divided equally between SMS firms, regardless of the number of designations held. If four firms are designated for the full year, each pays 25% of the SMS levy (Para 2.21 of the Draft SMS Levy Rules). This equal-split approach sidesteps complex attribution issues while ensuring transparency and accountability.

The consultation, which closed on 3 July 2025, outlined how the CMA will calculate qualifying costs comprising staff costs, non-staff costs, and overhead costs associated with exercising its digital markets functions (Para 2.1 of the Draft SMS Levy Rules). The approach ensures that the aggregate amount payable by SMS firms cannot exceed the costs incurred by the CMA in a given chargeable year, with money raised through the levy returning to the Consolidated Fund (Para 2.6 of the Draft SMS Levy Rules).

The worked example provided in the consultation demonstrates the practical application (Para 2.25 onward of the Draft SMS Levy Rules). In a hypothetical chargeable year with £18 million in qualifying costs, firms designated at different times would pay proportionate amounts. Firms designated for the full year would each pay £6.875 million, while firms designated partway through the year would pay proportionally less based on their designation period. (Paras 2.27-2.32 of the Draft SMS Levy Rules)

The Path Forward: October and Beyond

As we move beyond the 20 August 2025 consultation deadline, attention turns to the statutory deadline for final SMS decisions. The CMA must publish its final decision notice by 22 October 2025 for both the Apple and Google mobile platform proposed designations.

If the SMS designation is confirmed in October, both Apple and Google will face specific conduct requirements and potential pro-competitive interventions designed to address identified market failures under Chapter 3 of the DMCCA. The CMA’s approach includes detailed roadmaps for possible interventions, showing how the authority intends to prioritize conduct requirements and pro-competition interventions.

The CMA has indicated that it may extend Google’s designation to Google Search services as well on 24 June 2025, proposing Strategic Market Status designation for general search and search advertising services commanding over 90% of UK queries. More significantly, the CMA signalled its methodical expansion plans, stating it will consider further SMS designation investigations in early 2026 after progressing current cases through 2025. This phased approach reflects the regulatory learning curve mastering SMS intervention through Apple and Google’s initial designations before expanding the regime’s reach across digital markets.

The implications extend far beyond the immediate targets. The SMS regime represents the UK’s distinctive answer to platform power, offering a model that differs significantly from the EU’s prescriptive approach. The evidence-based approach, surgical precision in targeting specific market failures, and sustainable funding mechanism represent innovations in digital market regulation.

AI and Future Technological Challenges

The investigations have also grappled with how artificial intelligence might reshape competitive dynamics. The CMA’s forward-looking analysis suggests emerging technologies are more likely to strengthen rather than weaken established platforms’ positions over the next five years (Paras 6.132-6.135 of APD); ( Paras 6.140-6.143 of GPD).

AI tools distributed as native apps remain reliant on existing app stores for distribution (Para 7.18 of APD), while the integrated hardware-software approach of dominant platforms may provide competitive advantages in AI implementation (Para 7.53 of GPD). This finding suggests that technological change alone will not solve the competitive problems identified in digital markets. Rather, the advancement of AI technologies may allow further entrenchment of market position of Apple and Google in the Mobile Platform market.

As we await the October decisions, the transformation achieved in less than nine months from the first SMS investigations to provisional designations demonstrates the DMCCA’s potential. The UK has moved from legislative aspiration to market reality with remarkable speed and sophistication.

The cloud services market investigation’s conclusion that DMCCA powers are superior to traditional remedies reinforces this transformation. The CMA noted that existing market investigation tools are designed for one-off interventions and are not well suited to tackling entrenched market power in digital markets (Para 10.106(a) of the CSMI). The DMCCA’s advantages of wide-ranging intervention powers, flexibility for iteration, testing capabilities, and ongoing oversight represent a fundamental evolution in UK digital market regulation.

The CMA’s recommendation to prioritize SMS investigations for Microsoft and AWS in cloud services signals the regime’s expansion beyond mobile platforms. This strategic decision would address market-wide concerns affecting most UK customers while creating indirect competitive effects across the cloud ecosystem. The CMA has indicated it will consider further SMS designations in early 2026 (Para 10.104 of the CSMI), suggesting a measured but comprehensive approach to digital market regulation.

Conclusion: Beginning of the DMCCA Era in UK Digital Markets

The DMCCA has evolved from legislative hope to regulatory reality in remarkable time. What began as theoretical framework in May 2024 has delivered comprehensive investigations, provisional designations, and market-wide interventions by August 2025. The evidence against the world’s largest technology companies spans market structure, competitive dynamics, consumer behaviour, financial performance, and technological trends demonstrating regulatory action that that combines economic rigour with practical enforcement capability.

The integration of traditional market investigations with the new SMS regime proves particularly significant. The cloud services investigation’s finding that Microsoft and AWS would qualify for SMS designation based on substantial market power, strategic significance, and global revenues exceeding £25 billion shows how the DMCCA creates coherent regulatory architecture across digital markets. Rather than imposing immediate remedies, the iterative SMS approach allows testing, refinement, and ongoing adaptation- essential capabilities given market complexity and rapid technological change.

The consumer research components throughout all investigations demonstrate a regulator genuinely committed to evidence-based decision-making. From Progressive Web App usage data to consumer switching surveys, the CMA has built empirical foundations that will withstand legal challenge and market evolution.

The era of unrestrained platform power is ending, and the UK is leading toward a new equilibrium that preserves innovation while ensuring competitive markets serve consumer interests. The October 2025 decisions will mark not just individual investigation conclusions but the full operationalization of a regulatory framework that could reshape global approaches to digital market governance demonstrating that thoughtful, evidence-based regulation can deliver results without stifling innovation while serving both economic efficiency and democratic accountability.

If you do not want to miss any of our future blog posts, you can subscribe to the SCiDA-Newsletter here.